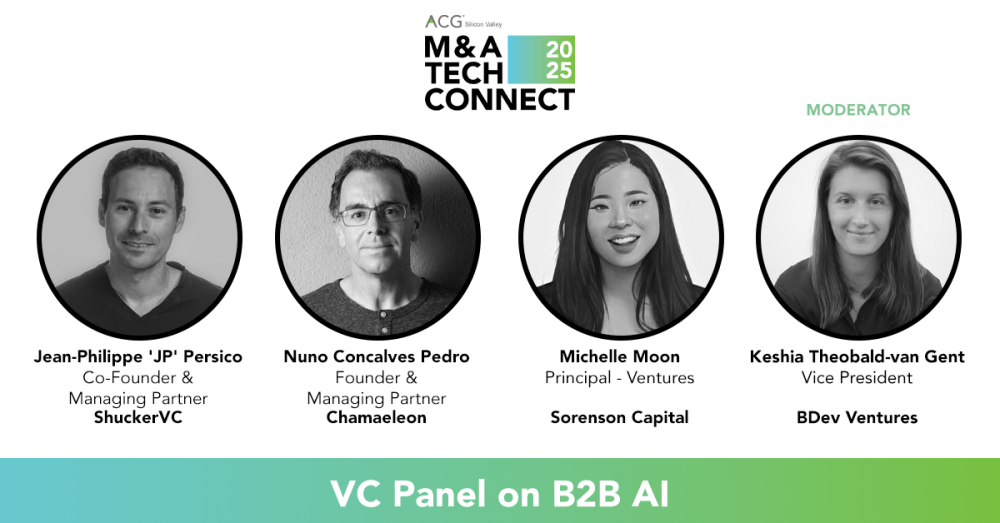

Session Details

This panel brings together participants from every stage of the startup funding cycle - from venture studio to late-stage growth fund - to discuss the state of B2B AI investing and share predictions for 2025. Bring your questions!

Speaker Bios

Michelle Moon, Principal - Ventures @ Sorenson Capital

Michelle Moon is an early-stage investor specializing in artificial intelligence. As a principal at Sorenson since 2022, she partners with founders building transformative AI-driven companies.

Michelle is unafraid to back founders at the earliest stages, recognizing that the first critical decisions can shape a company’s trajectory. She is committed to being a hands-on, value-add partner throughout the startup lifecycle—offering strategic insights, support, and a strong network to help founders navigate the challenges of scaling AI businesses.

Passionate about backing bold, disruptive ideas, Michelle seeks out entrepreneurs who, like herself, don’t always fit the traditional Silicon Valley mold.

Originally from Canada, Michelle is a CFA charterholder. She holds an MBA from The Wharton School at the University of Pennsylvania and an International BBA from the Schulich School of Business at York University.

----------------------------------------------------------------------------------------------

Nuno Goncalves Pedro, Founder & Managing Partner @ Chamaeleon VC

Nuno is the founder and managing partner of Chamaeleon, a unique early-stage VC firm with a disruptive operating model and quantitative & technology platform - Mantis - developed and maintained fully in-house to augment its deal sourcing, due diligence, risk, portfolio management and liquidation activities. While based in the San Francisco Bay Area, the Firm also has offices in Europe, as well, and it focuses on series Seed and Series A investing. Nuno is particularly focused on consumer and consumer-like start-ups, e.g. gaming and social, as well as horizontal SaaS, e.g. consumerized Enterprise and bottom-up SaaS.

Before this, Nuno founded and was the managing partner of Strive Capital, the first quant early-stage VC firm in the US and in the San Francisco Bay area. The firm focused on consumer and enterprise software, with investments in DraftKings (IPO), Robinhood (IPO), Ohmconnect (Merger Google), Rubrik (IPO), Gusto, App Annie (Sold), Enish (IPO), Virta Health, among others.

He is the co-founder and co-host of decipheredshow.com, a top 3% podcast, globally, and the creator of the “Rejection & Adversity as a path to Growth” methodology (bit.ly/3badkvb). Nuno has served and continues to serve as a board member, advisor and coach to various start-ups, corporations and nonprofits in the US, Europe and Asia.

Nuno was a Senior Expert and member of APAC Technology, Media & Telecom leadership team for McKinsey, where he created impact for Fortune 500 clients, including consumer electronics, network equipment, carriers/operators, Internet players, sovereign wealth funds and private equity funds. Nuno was previously the Head of Strategy, Product, Corporate & Business Development for the GSM Association, where he created and executed, at its inception, the blueprint that led to the GSM Association becoming the leading non-profit for Mobile globally.

Nuno is a guest lecturer on product management and growth at Stanford GSB and Haas School of Business, University of California Berkeley. He is also a guest lecturer on Venture Capital and innovation topics at the Wharton School of the University of Pennsylvania and the College of Engineering of the University of California Berkeley. Nuno is an alumnus of Stanford, London Business School, and other world-renowned organizations.

----------------------------------------------------------------------------------------------

Jean-Philippe Persico, Co-Founder & Managing Partner @ shuckerVC

Jean-Philippe 'JP' Persico is a Co-Founder and Managing Partner at shuckerVC, a Bay Area seed fund investing in AI-powered B2B software companies. With over 20 years of experience in business transformation and corporate growth development, JP has established himself as a proven venture investor and operator.

As the former Head of Strategy and Corporate Venture Capital (CVC) for Bosch, JP led investments, joint ventures, and new venture developments. His operational experience includes serving as VP of Platform and Business Development at Curbee, where he drove 20x corporate business growth and optimized operating margins.

----------------------------------------------------------------------------------------------

Keshia Theobald-van Gent, Vice President @ BDev Ventures - moderator

Keshia Theobald-van Gent is an accomplished executive with expertise in venture capital, go-to-market strategy, and partnerships. As Vice President at BDev Ventures, she leads sourcing and operations across the fund. Previously, Keshia served as Director of Portfolio Success at BDev Ventures, where she established and scaled a global operations team to enhance pre- and post-investment experiences for startups.

Before joining BDev, she served as the U.S. Senior Director at German Accelerator, managing bi-coastal and global startup programs, and advising founders on U.S. market expansion. At GSVlabs, as Director of Strategic Partnerships, she connected global corporations with high-growth startups, managed corporate innovation initiatives, and led . Her leadership helped align corporate strategies with cutting-edge solutions, creating long-lasting value for both startups and enterprise clients.

She also founded Dialog to Learn, an EdTech nonprofit improving student literacy in low-income elementary schools.

With a Master's from the University of Groningen and a Bachelor's from NKU, Keshia brings a unique interdisciplinary approach to building ecosystems that drive innovation and success. A frequent speaker at industry events and a published author, she also serves as an advisor to startups.