Share:

Image

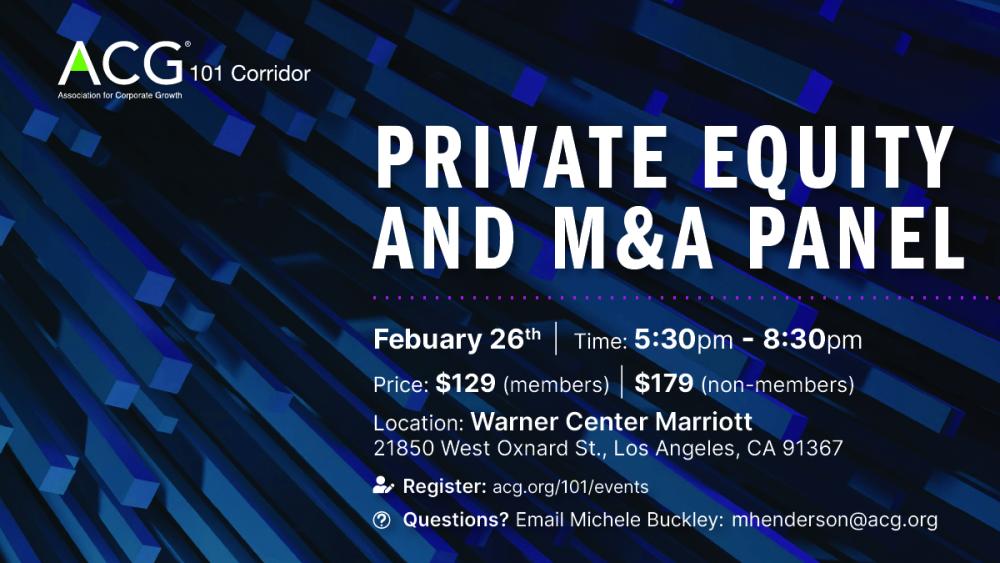

Event Details

When:

February 26, 2025 5:30 PM - 8:30 PM PST

Where:

Location Name

Warner Center Marriott

Overview

Body

Private Equity and M&A Panel- 2025 Opportunities & Potential HeadwindsJoin ACG 101 for a live panel discussion on the Current State of Private Equity and Middle Market M&A.The panel will be led by Alidad Damooei, Partner and M&A attorney at Stradling, with a market overview given by David Bonrouhi, Co-Founder and Managing Director of the investment banking firm, Calabasas Capital.Topics will include a 2025 M&A market outlook, recent trends in deal volume, valuation, deal structuring, leverage, inflation, tariffs, interest rates, and industry-specific deal dynamics.

Agenda

- 5:30PM - 6:30PM: Networking, Drinks & Apps

- 6:30PM - 7:30PM: Panel Discussion

- 7:30PM- 8:30PM: Q&A & Final Networking

Register Now!

- Members: $129

- Non-Members: $179

*** Dress is business casual

*** Drinks and appetizers will be served at the event

ACG 101 encourages Uber or other ride share options when drinking alcoholic beverages

Speakers

Hosted by: ACG

Chapter

101 Corridor